APPLIED METHODOLOGY

The ENGIE Group has identified 17 material ESG issues on the basis of its dual materiality analysis, which are listed below.

With its double materiality analysis conducted between September 2023 and May 2024, ENGIE is now part of the dynamic driven by the European CSRD (Corporate Sustainability Reporting Directive) of 2023, which aims to harmonize the extra-financial reporting of companies headquartered within the European Union, as well as the reporting of their subsidiaries worldwide.

This double materiality analysis makes it possible to identify the ESG topics on which ENGIE has a significant socio-environmental impact (positive or negative) and those with a major effect (risks or opportunities) on the Group's financial performance.

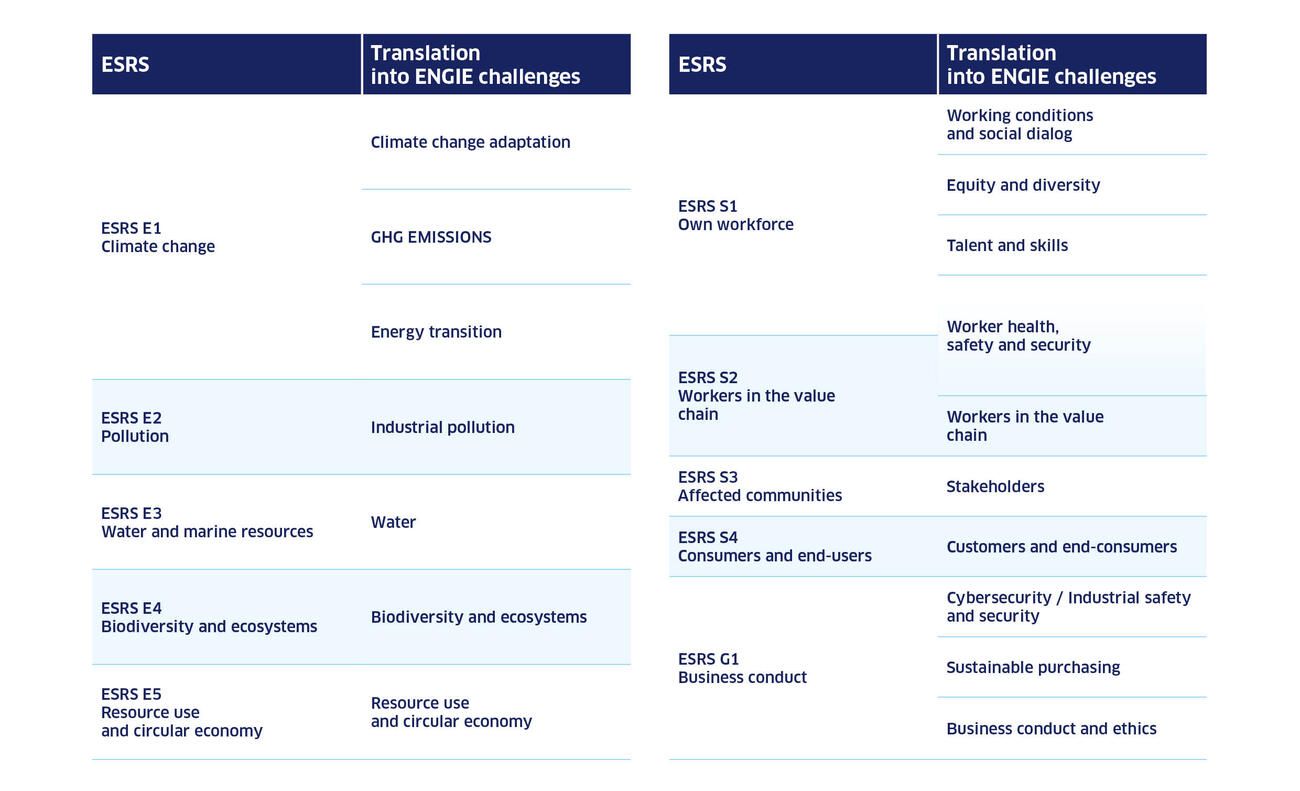

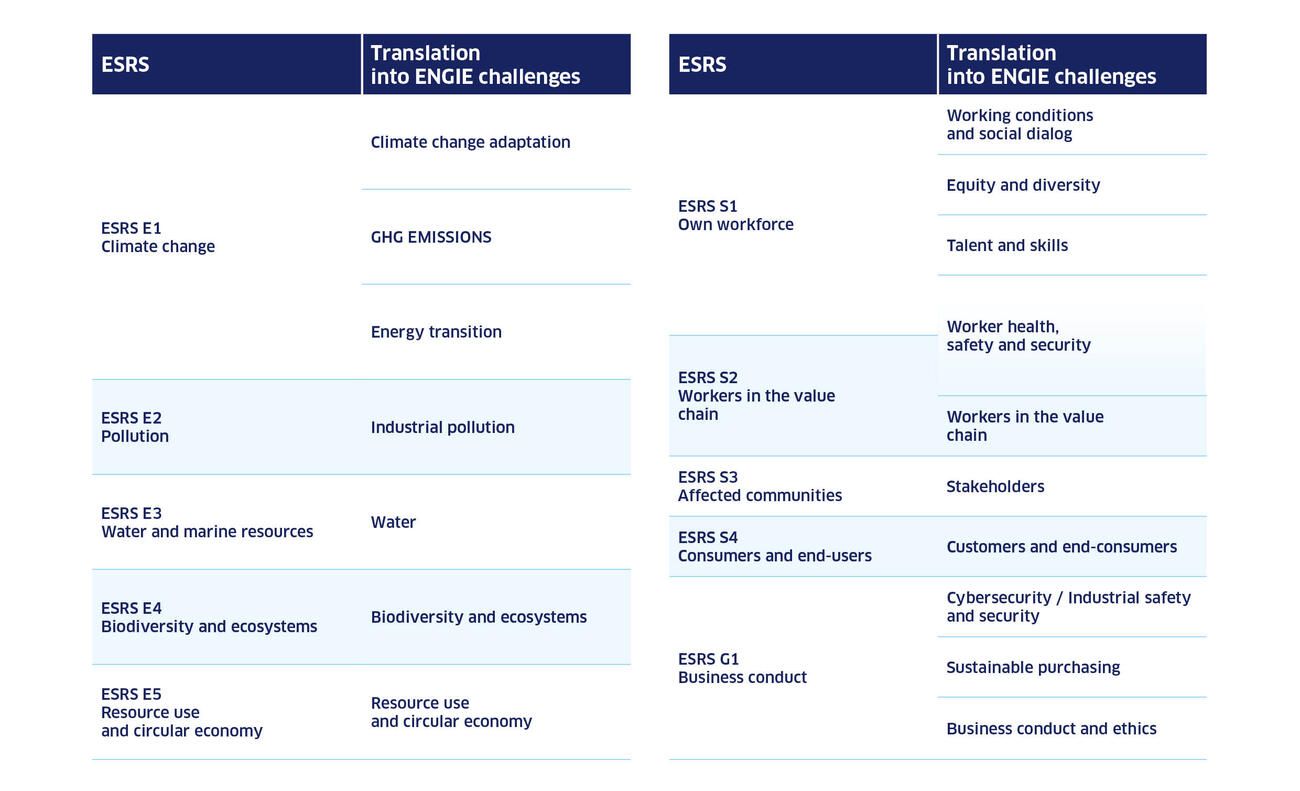

The analysis led to the selection of 17 material ESG issues, listed below and in correspondence with the CSRD's ESRS (European Sustainability Reporting Standards) thematic standards.

The ENGIE Group has identified 17 material ESG issues on the basis of its dual materiality analysis, which are listed below.

The first stage consisted in selecting a preliminary list of twenty or so potentially material ESG issues, drawn from the Group's previous materiality matrix, the sustainability topics listed by the CSRD and a benchmark of ENGIE's peers.

These issues were then broken down into more detailed sub-issues, which served as a framework for identifying positive or negative socio-environmental impacts and associated financial risks and opportunities (IROs), the subject of the second stage.

IROs were identified by mobilizing some fifty internal stakeholders in thematic workshops: two on the environment, two on social issues and two on governance. These six workshops led to the identification of a hundred or so negative or positive impacts and a hundred or so risks and opportunities, each of these IROs being attached to an ESG sub-issue.

Three important methodological points should be noted:

ENGIE then set itself a reasonable materiality threshold: all IROs with a score greater than or equal to this threshold were considered material, i.e. around a hundred material IROS.

Each issue or sub-issue with at least one material IRO is then itself considered material.

The results of the double materiality analysis were challenged with external stakeholders consulted through some twenty individual or group interviews on material issues. Representatives of suppliers, customers, shareholders, NGOs, employees, public institutions and affected communities were interviewed. For reasons of feasibility, some of these stakeholders were not consulted directly, but via their internal correspondents, who acted as external stakeholders.

Overall, these consultations enabled us to validate the work, and above all to enrich the assessments with numerous verbatims in support of the ratings in the assessment phases.

The list of challenges and material IROs were challenged by the Group's decision-making bodies: